The UK BESS market has moved beyond its infancy and into a phase defined by scale, structural reform, and financial sophistication. This article explores the structural fundamentals, revenue dynamics, and bankability considerations shaping UK BESS in 2026 and beyond.

The United Kingdom has established itself as one of the most advanced and investable battery energy storage system (BESS) markets in Europe. This position reflects both structural features of the UK power system and deliberate policy choices that have prioritised decarbonisation, system flexibility, and market‑based solutions. Rapid deployment of offshore and onshore wind, alongside increasing solar penetration, has materially changed the generation mix. At the same time, the closure of coal-fired power stations and the aging of the gas fleet have reduced the availability of conventional dispatchable capacity. The result is a power system characterised by greater volatility in wholesale prices, more frequent imbalance events, and increasing reliance on the balancing mechanism and ancillary services to maintain stability.

Battery storage has emerged as a highly effective response to these dynamics. BESS assets can respond within milliseconds, arbitrage intraday and capture real time price spreads, to either realise a gain prior to physical delivery or dispatch, as well as provide essential system services such as frequency response and reserves on standby.

BESS occupies an unusual but attractive position. It lacks the long-term revenue certainty associated with government backed contracts such as Contracts for Difference (CfDs), yet it avoids many of the risks inherent in traditional power generation such as fuel supply uncertainty. This makes BESS a hybrid asset class: riskier than contracted renewables, but with materially higher return potential especially given the price reduction of storage systems over the past two years. Mid to upper teen returns is a reality when senior debt is factored into the capital structure whereas solar CfDs achieve an upper single digit return.

Planning Pipeline

The UK has one of the deepest BESS pipelines in Europe, reflecting the growing need for flexibility in a power system with rising renewable penetration with deep liquid wholesale and balancing markets.

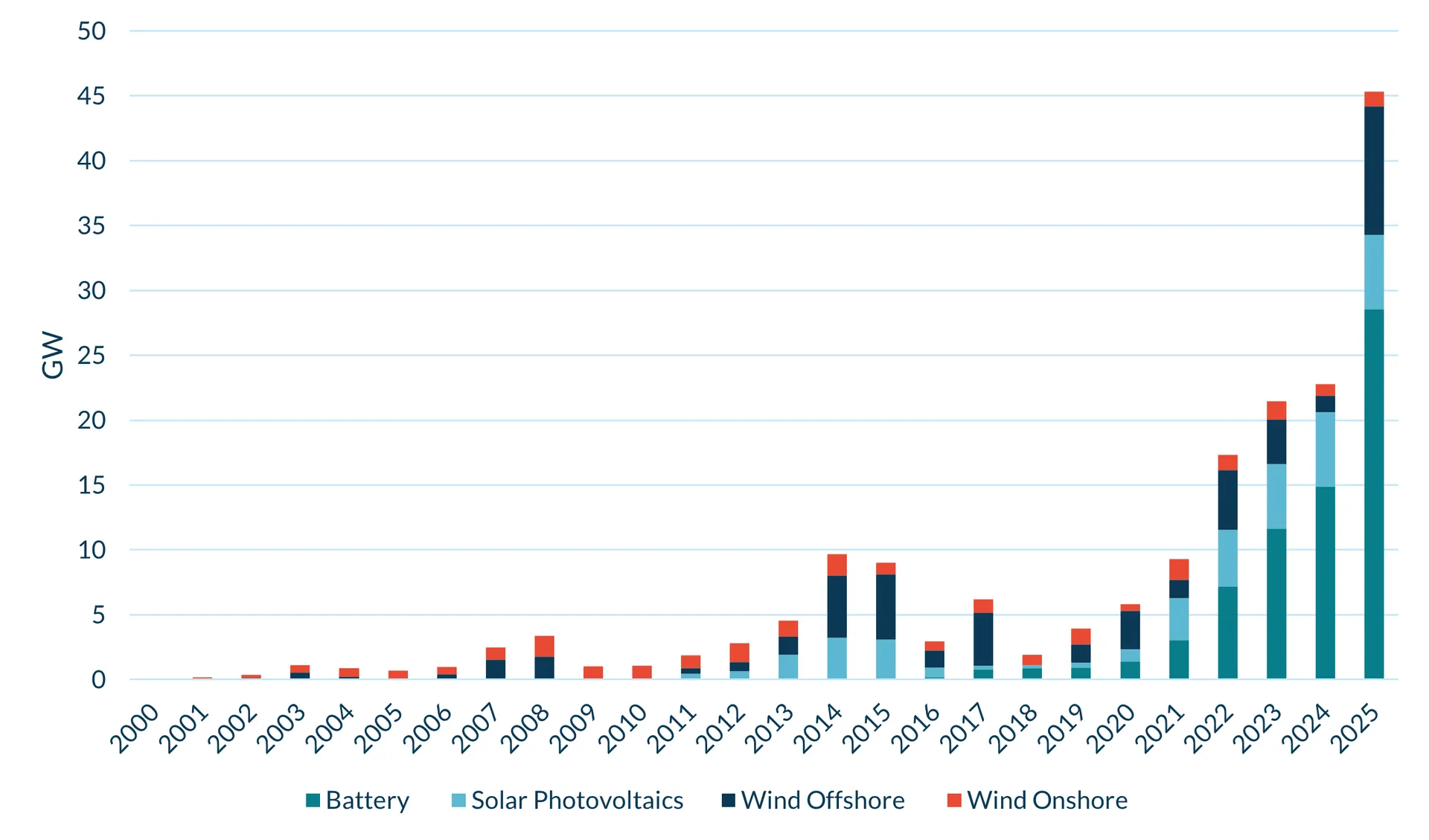

Selected renewables technology capacity by year in which planning permission was granted (Source: Cornwall Insight)

Planning approvals have accelerated significantly. Almost 30GWh of BESS capacity was consented in 2025 almost double the 2024 level, the highest annual total to date, with larger projects with longer duration becoming the norm, numerous single site schemes now exceed 1GWh. Cumulatively, approved projects now exceed 120GWh, while around 20GWh is under construction and some 10GWh is operational. Strong demand remains for well developed ‘Ready to Build’ BESS projects and Elgar Middleton is in contact with over 100 interested and willing buyers for the right project.

Grid Reform

The UK is undergoing the most significant reform of its electricity grid framework in decades, driven by the urgent need to connect low carbon generation, storage, and demand more quickly, while supporting the Government’s Clean Power by 2030 target. The centrepiece of reform is a wholesale overhaul of the grid connections process, led by the National Energy System Operator (NESO). Historically, grid access operated on a “first come, first served” basis, resulting in a severely congested queue of more than 700GW of generation and storage projects, many of which were speculative or inactive. Under the new “first ready, first connected” regime, projects must demonstrate planning progress, land rights, and strategic alignment with national energy needs to retain or secure a connection offer.

As of late January, NESO announced the 2026/27 transmission projects will not receive their offers by the end of January putting increased pressure on 2026/27 connection dates for both transmission and distribution projects. Many projects are in a state of limbo with neither equity investors nor debt providers willing to commit capital until the actual connection time and cost are confirmed for 2026/27 projects. With long lead times of 12-15 months for such item as switchgear and transformers, from order to installation timeframes means 2026 is near impossible for pre-construction projects and 2027 is becoming increasingly challenging. This could result in a depleted pipeline of constructed projects in 2026/27 putting even more pressure on the 2028 to 2030 rollout.

Revenue Stack Fundamentals

UK BESS revenues are typically derived from a diversified “revenue stack” rather than a single contracted offtake. The core components include:

-

- Wholesale Market (WM), capturing intraday and day-ahead price spreads;

- Balancing Mechanism (BM) participation, responding to system imbalances;

- Ancillary services, such as Dynamic Containment, Dynamic Regulation and Dynamic Moderation whereby assets are available to maintain grid stability and which are procured close to real time; and

- Capacity Market (CM) contracts, rewarding assets’ contribution to security of supply and which are often secured well in advance of construction.

The composition of the revenue stack is fluid. The suite of ancillary services has changed over time, and the current products historically offered attractive margins, particularly during early market phases when competition was limited. However, these revenues have shown rapid price erosion as new capacity enters the market and markets saturated. In contrast, WM and BM revenues are deeper and structurally more durable, but all trading revenues are inherently volatile and exposed to macro drivers such as gas prices, interconnector availability, and weather.

For debt providers, the critical question is not whether any particular revenue stream(s) can form a business case for a storage asset but whether a combination of these can be underwritten with sufficient confidence over the debt tenor. Fully merchant revenue stacks may be acceptable for equity investors seeking upside, but they pose challenges for lenders required to size debt against downside scenarios. As a result, bankability is increasingly linked to revenue stabilisation mechanisms; however, where lenders have a high degree of confidence in and understanding of the revenue forecasts, material levels of non-recourse debt can be supported by merchant cashflows for appropriately structured projects.

Revenue Volatility, Forecasting and Duration

Market forecasting lies at the heart of BESS financing and is often the most heavily scrutinised element of lender due diligence. Unlike contracted renewables, BESS revenues cannot be extrapolated from a fixed tariff or a single price curve. Instead, they require sophisticated modelling of, dispatch optimisation based on the appropriate level of foresight available to traders at the time. The modelling is more challenging still in less developed storage markets in which rules for market participants are still evolving. Most financings rely on independent market consultants to develop merchant revenue forecasts. These forecasts typically combine historical price data, forward market curves, and fundamental modelling of supply, demand, and capacity additions. Importantly, they also attempt to capture the impact of increasing BESS penetration on future profit pools, such as in ancillary services where saturation can (and did) occur quickly.

Sensitivity analysis is also critical. Lenders will test downside scenarios including reduced price volatility, faster than expected battery build out, and increased competition from flexible gas or new interconnectors. Unlike in the financing of renewable generators, lenders also need to consider the performance of the asset optimisers; this is typically covered both by sensitivity analysis but also by ensuring debt and equity providers are able to incentivise optimiser performance appropriately.

A further challenge for forecasters is that there is no such thing as a generic asset. Location (which informs the ability to capture outsize revenues in the BM) and technical parameters (including round-trip efficiency, degradation, and duration) are important inputs into the dispatch modelling. There is often an iterative process required to determine the best site configuration taking into account site-specific constraints (available land, planning permission, any grid limitations) and the economics of longer / shorter durations, higher / lower cycling, etc.

As a consequence of reduced cells prices and increased cell density the UK market can now support up to 4 hour duration as a realistic base case system, but analysis of market forecasters curves and cell prices has demonstrated this may not necessarily be optimal and a one size fits all is not the way forward. Elgar Middleton is working closely with a number of equity investors and debt providers to find an optimal solution for each client, taking into consideration round-trip efficiency, degradation, and durations ranging between two and four hours.

A further dimension is operational strategy: aggressive cycling to maximise short term revenue may reduce long term asset value through accelerated degradation. Elgar Middleton has structured loan agreements with a number of debt providers to offer equity investors maximum flexibility to cycle an asset aggressively when the market dictates it makes sense, while aligning short term dispatch strategies with warranty constraints, lifecycle optimisation and senior debt tenor by using structured upside and downside cash sweep structures.

Revenue Structures

The UK market has rapidly evolved with many optimisers now active in the market with a range of products. While the market is predominantly dominated by the big utility companies, other optimisers include dedicated boutiques with bespoke trading algorithms, energy trading desks of investment banks, equipment manufacturers and in-house specialists using their platform to manage their own assets. Leaderboards of all publicly traded markets rank the various optimisers performance, although the producers of those benchmarks would be the first to acknowledge their limitations – not least that they will not capture all revenue sources of the various optimisers.

Several contractual structures are now common:

-

- Fully merchant optimisation, where a specialist provider operates the asset in return for a performance‑linked fee.

- Tolling arrangements (physical or virtual), under which a counterparty pays a fixed or semi‑fixed fee for control of dispatch.

- Revenue guarantees or minimum revenue floors, providing partial revenue protection in exchange for more limited upside.

From a lender’s perspective, the value of these contracts lies not just in reducing volatility, but in reallocating risk to parties better able to manage it. Counterparty credit quality, contractual tenor, benchmarking and termination rights are all debated at great length with lenders in order to find a bankable solution.

In the current market, the majority of clients of Elgar Middleton wish to maximise gearing in order to optimise equity IRR – and given the significant divergence between the cost of capital of equity and debt; structured debt significantly improves equity returns. As more assets reach operation and performance data accumulates, both optimisers and capital providers are converging on structures that balance risk sharing with economic efficiency, thereby improving overall bankability. Two years ago, floors were all the rage while tolls offered little value to equity investors given the relative pricing of floors vs tolls. Fast forward to today and the floor market is now thin while there is healthy competition between physical and virtual tolls and as duration increases, there is more flexibility to hedge only a portion of the total MWh to find an optimal mix of hedge vs merchant component in order to structure a highly geared project with equity upside.

Elgar Middleton undertakes this analysis using a bespoke financial model for each client as there are some subtle differences between each route to obtaining a level of contracted revenue capable of supporting high levels of debt.

Outlook for UK BESS Financing

The outlook for UK BESS financing is positive, but increasingly nuanced. Demand for grid scale storage is structurally supported by the UK’s decarbonisation trajectory, electrification of heat and transport, and continued renewable build out. As a result, BESS is likely to remain a core component of the UK power system for decades.

Not all BESS projects will be treated equally. Elgar Middleton can attest from the sale of our clients’ RtB projects that those that combine strong grid locations, strong phase 2 grid offers, low or no curtailment, longer duration and limited planning conditions will always attract strong interest.

Equity investors are rightly focussed on grid reform at the moment and concerned about the timing of (1) grid offers and (2) actual connection dates which has proved critical to some given the challenges of actually building out the upgraded grid network up and down the country.

Lenders are mostly concerned with revenue structures, cycling strategies and counterparty risk especially given the multitude of varying solutions available from the market but as more structured products become available debt tenor and levels of gearing are both increasing.

Elgar Middleton has closed almost 2GWh of BESS, both RtB sales and numerous debt transaction using fully merchant, floors and tolls and understands the unique idiosyncrasies of each. Ultimately, successful financing of UK BESS projects will depend on a clear understanding of where risk truly sits and structuring projects accordingly.