AD projects in the UK are leveraging innovative revenue streams such as gas-to-grid integration, RTFCs, and CO₂ recovery to enhance financial viability. These trends present an attractive proposition for lenders

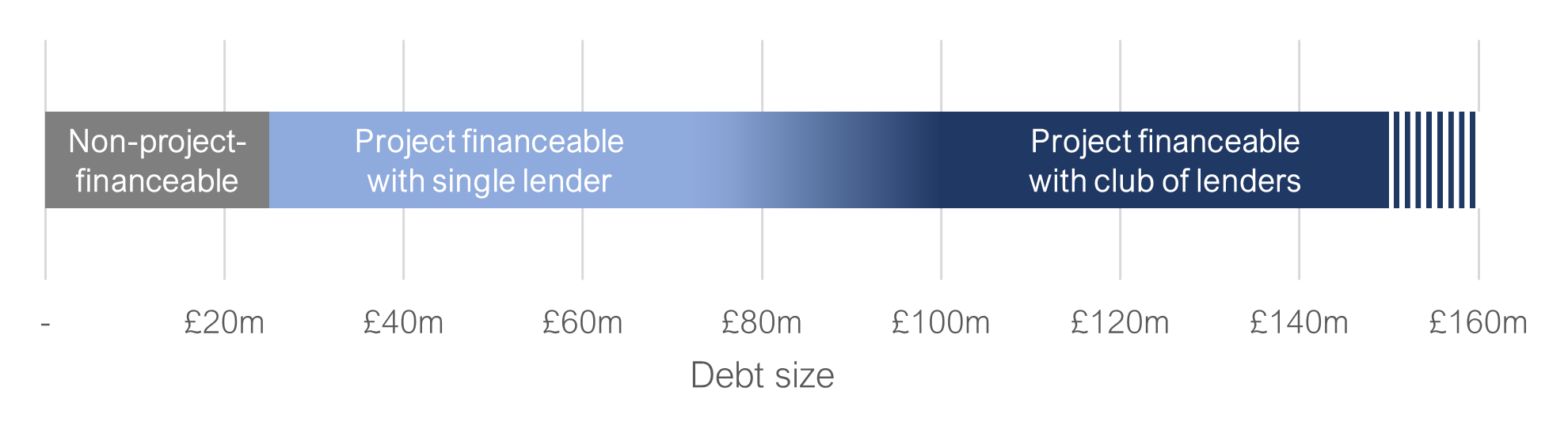

Financing anaerobic digestion (“AD”) projects has historically been a challenge due to significant capital expenditure, high running costs, volatile revenues and other perceived risks around the actual process.

However, until around a decade ago, projects could rely on FITs and ROCs to support electricity generated from CHP units and RHI payments to support gas injected into the grid. Raising debt finance for an operational asset with these support payments and documented operational history was therefore possible as this mitigated a number of the risks.

Most AD plants in operation today benefit from one of these subsidy payments. As these are no longer available for new developments the financial landscape of AD projects has evolved, primarily driven by innovative revenue models that go beyond just electricity generation and RHI payments.

Revenue streams from additional gas-to-grid integration with the Green Gas Support Scheme, associated subsidies like Renewable Transport Fuel Certificates (RTFCs) and carbon dioxide recovery are gaining traction, making AD projects more attractive again to debt providers.

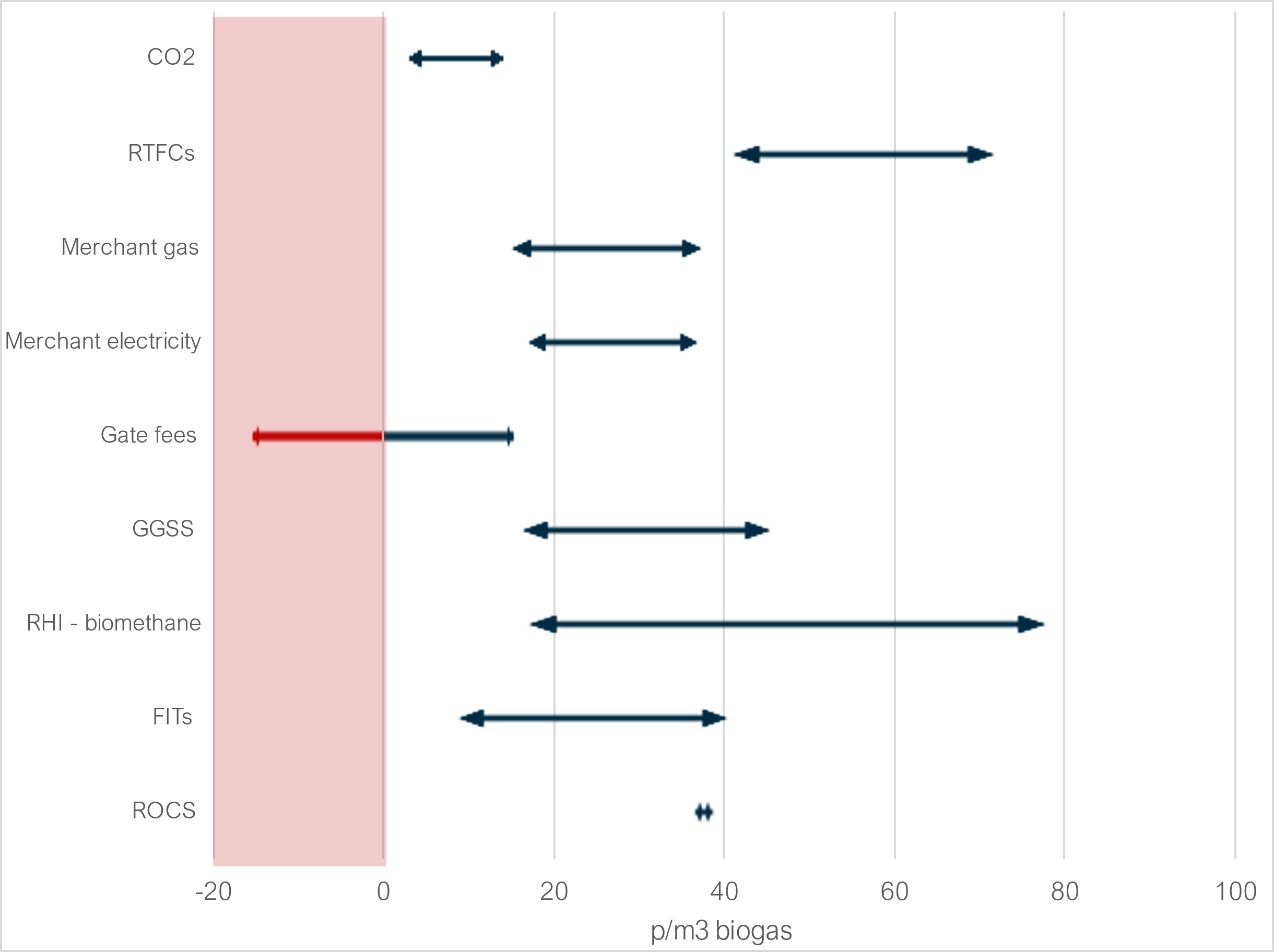

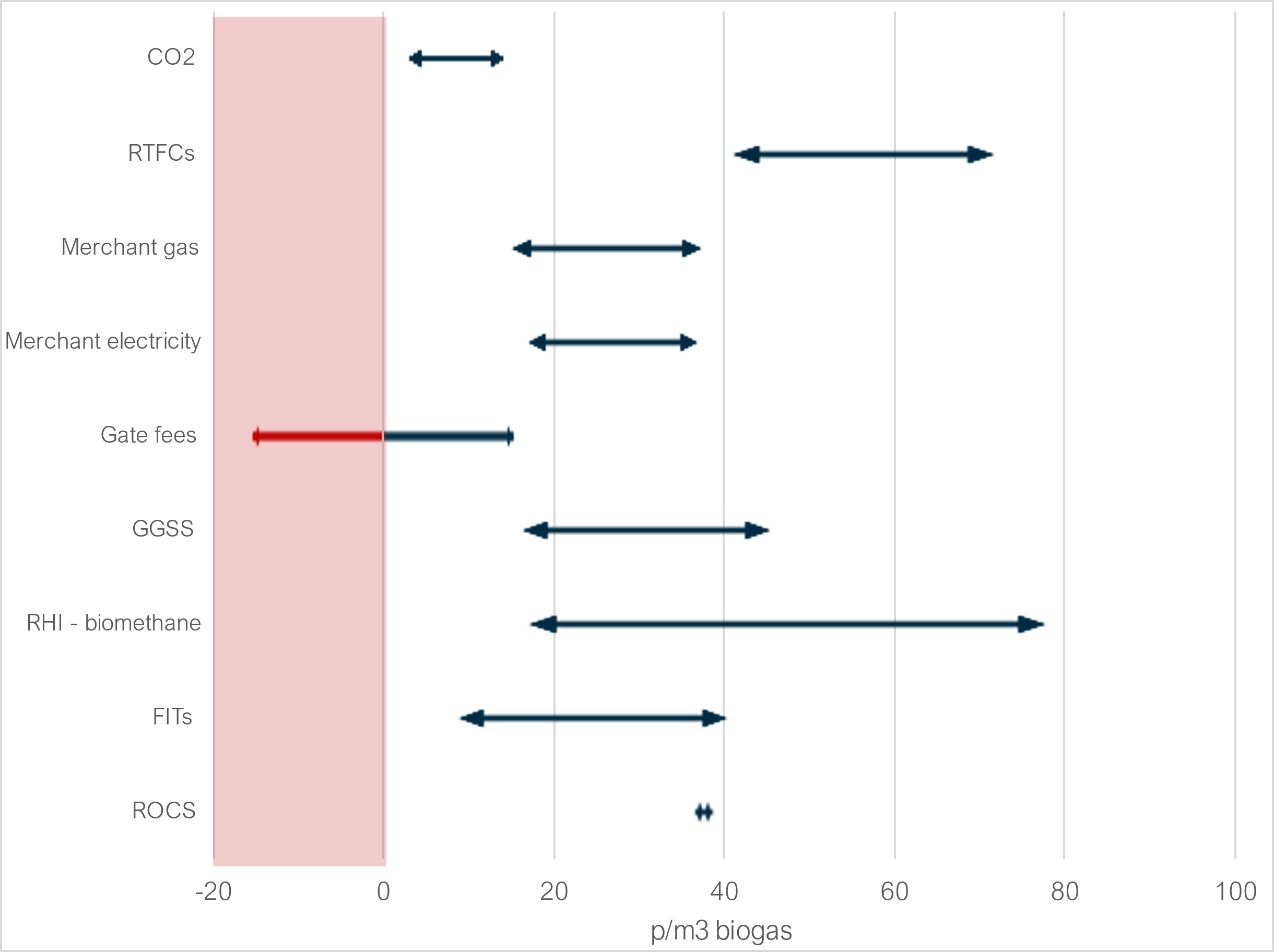

The approximate income from some of these revenue streams is shown below.

Gas-to-Grid Integration

Biomethane, produced by upgrading biogas, is a renewable and sustainable alternative to natural gas. Under the previous subsidy regimes, a number of AD plants were built with gas-to-grid connections; however, many of these projects involved contractual arrangements with Air Liquide rather than direct management of the equipment and sale of the gas through a Biogas Purchase Agreement (BPA).

A key trend recently is to install new gas-to-grid connections to inject biomethane into the national gas grids and to manage the sales of the gas through a BPA. This gives the projects access to current high gas prices and also allows for price fixing which provides a stable revenue which is very attractive to lenders. Furthermore, where projects already have a CHP unit in place, it allows the sponsor to optimise returns by choosing whether to run the CHP or to inject gas into the grid.

Unusually, this is also an area that benefits from a new subsidy – the Green Gas Support Scheme. Under this scheme generators are able to apply for a 15 year support payment which is linked to CPI. This is a very attractive revenue stream when looking for debt finance.

Renewable Transport Fuel Certificates (RTFCs)

RTFCs have also emerged as a potential revenue driver for AD projects, particularly those that supply biomethane.

RTFCs are awarded to producers of renewable fuels that are used for transport. Crucially, the generator is still eligible for the certificates through a sleeving arrangement. Therefore existing gas-to-grid plants that are not eligible for the Green Gas Support Scheme are able to sell their gas to transport companies that take their supplies from the grid.

The pricing of the subsidy is more volatile than the Green Gas Support Scheme, so this option is probably a second choice for new generators; however, governments are mandating increased use of renewable fuels in transport which has resulted in increased demand for RTFCs.

RTFCs are also tradable, allowing producers to optimise their value based on market conditions.

We think that this stream of revenues would certainly be useful for sponsors, but would need to be part of a larger mix to attract debt finance.

CO₂ Recovery

The capture and commercialisation of CO₂ from biogas upgrading is an emerging trend that also enhances AD assets’ economics.

The process involves separating carbon dioxide during the biomethane upgrading process and selling it to industries such as food and beverage, agriculture, or even for carbon sequestration purposes.

With increasing focus on carbon-neutral solutions, demand for sustainable CO₂ sources is rising.

Many AD projects are now integrating CO₂ capture technologies, supported by government grants or incentives for carbon capture and utilization (CCU) initiatives.

Again, this is very much a nice to have revenue stream and would need to be part of wider revenue mix to attract debt finance.

Waste management and gate fees

The investor case for many of the existing AD plants relied on gate fees for processing food waste. Unlike other sectors, such as biomass, AD plants were being paid to receive feedstock. Unfortunately, some of these fees have not been as high as expected, and in some cases, AD plants have had to pay for the waste.

The tightening of environmental regulations, including landfill bans and the future organic waste separation mandates should increase demand for sustainable waste treatment solutions like AD. Many in the sector are confident that gate fees will rebound to investor expectations from a number of years ago. Location of competitors and proximity to food waste will remain a key driver to the pricing.

For project sponsors, securing long-term contracts for waste supply with steady gate fee revenues enhances the financial stability and bankability of AD plants.

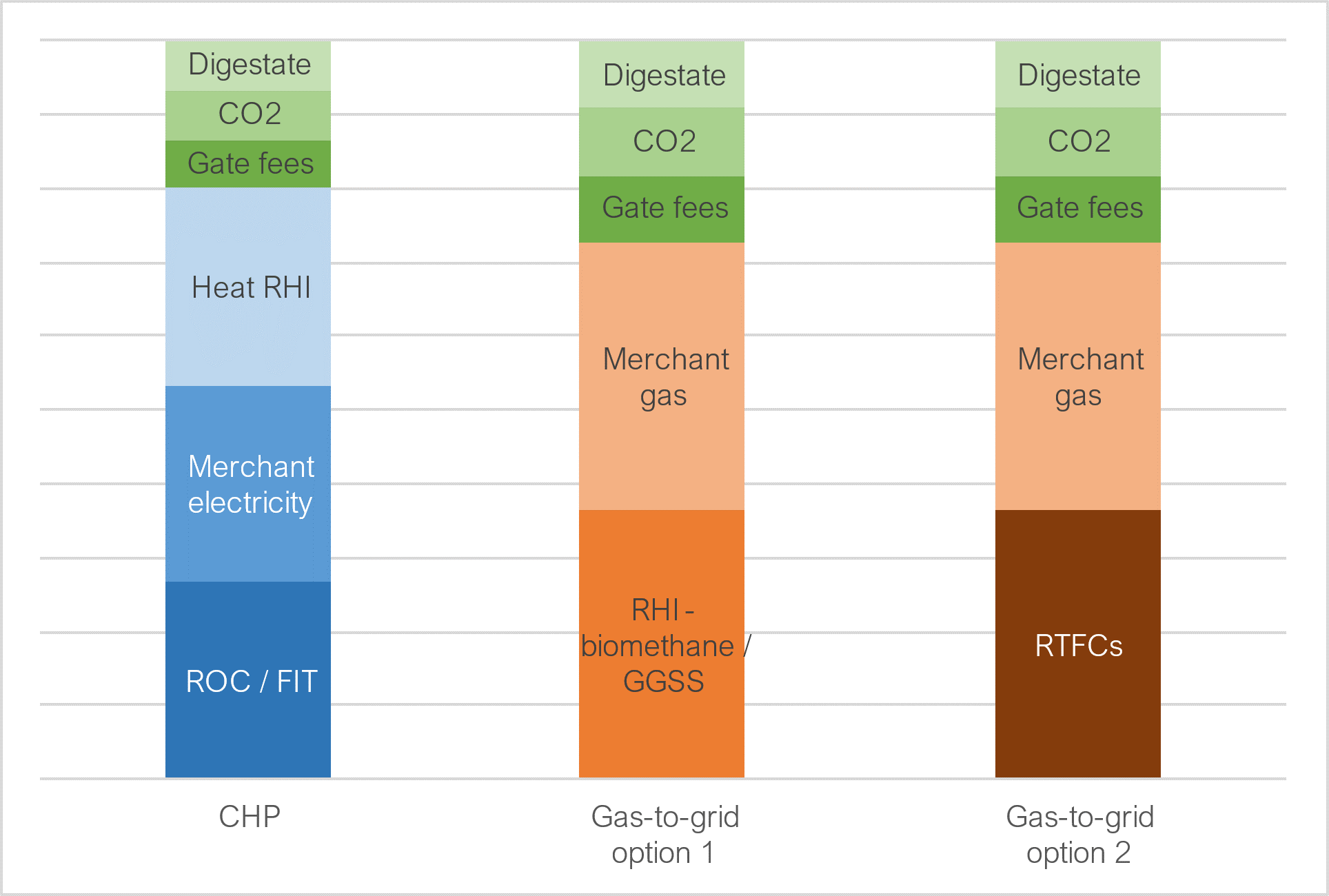

Revenue stacking

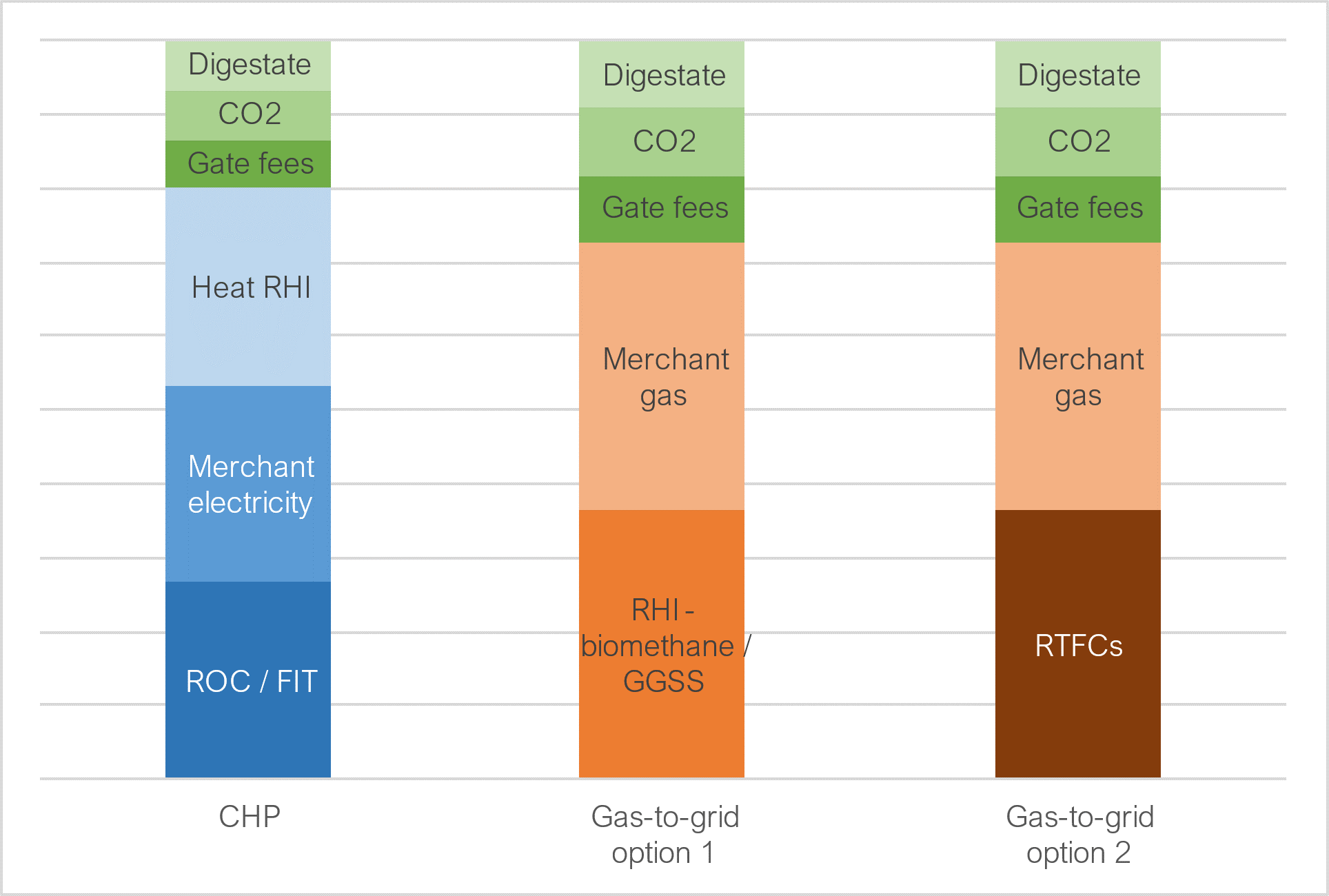

Many of these revenues can be claimed at the same time as shown in the graphs below.

Agriculture

At EM our focus has been on AD plants based on food waste, but there are many agricultural AD plants which use the same technology to process slurry and energy crops such as maize. These fell out of favour as whilst the processing of slurry is indisputably good for the environment, the increasing reliance on energy crops such as maize was not considered to be as helpful.

Traditionally, they have been much harder to debt finance as lenders do not like the exposure to individual farmers who provide the crops and are largely not creditworthy. The perceived risk is that the AD plant may need to source its crops from an external market at a prohibitive cost when delivery is factored in.

That said, for many investors, agricultural AD has been one of their best and most reliable performers.

All the comments above about new revenue streams should apply to this sector as well.

Key considerations

While new revenue streams significantly enhance the bankability of AD projects, they come with challenges.

Gas-to-grid infrastructure and CO₂ recovery systems require substantial capital investment and advanced technology. They need to be designed correctly and installed by reliable bankable counterparties. Lenders may also need time to become comfortable with the new revenue streams.

Furthermore, subsidies such as RTFCs and support schemes for biomethane are subject to political shifts, posing risks to long-term revenues. The value of RTFCs and CO₂ themselves fluctuate based on supply-demand imbalances and policy changes.

Conclusion

The AD sector is rapidly evolving, with new revenue opportunities reshaping its financial landscape. These trends not only improve the financial viability of AD projects but also align them with global decarbonisation goals. For project developers and investors, understanding and leveraging these revenue streams is critical to unlocking the full potential of AD projects in the renewable energy transition.